The vacancy rate is a critical real estate indicator influencing property values, market trends, and decisions. High rates signal oversupply, potential price depression, while low rates indicate strong demand. Homeowners, investors, and professionals use vacancy data for strategic planning, community engagement, and optimizing transactions based on market dynamics. Understanding vacancy rates facilitates informed decisions, risk management, and long-term neighborhood vitality.

The real estate market is a dynamic landscape where various factors influence homeowner decisions, among them, the vacancy rate stands as a pivotal indicator. Understanding its impact on property owners’ choices is crucial for navigating this ever-changing realm. This article delves into the intricate relationship between vacancy rates and homeowners, exploring how these figures influence buying, selling, and investment strategies. By examining market trends and their interplay with vacancy dynamics, we aim to equip readers with valuable insights, enabling them to make informed decisions in a competitive real estate environment.

Understanding the Link Between Vacancy Rates and Homeownership

The relationship between vacancy rates and homeowners’ decisions is a complex one, deeply intertwined with various market indicators. High vacancy rates, often indicative of an oversupplied market, can significantly influence buyers’ preferences and pricing dynamics. When supply outpaces demand, homes remain unoccupied for extended periods, signaling to prospective buyers that the market may be unfavorable. For instance, in regions like the US Midwest during economic downturns, vacancy rates surged, leading to a downward pressure on home prices and prompting buyers to pause their search.

Homeowners are keenly aware of these market dynamics, using vacancy rate data as a crucial tool for assessing property values and neighborhood desirability. Areas with consistently low vacancy rates, on the other hand, suggest a healthy balance between supply and demand, often attracting investors and first-time buyers alike. For example, densely populated urban centers like New York City typically boast low vacancy rates due to high demand, driving up property values and creating a competitive environment for potential homeowners.

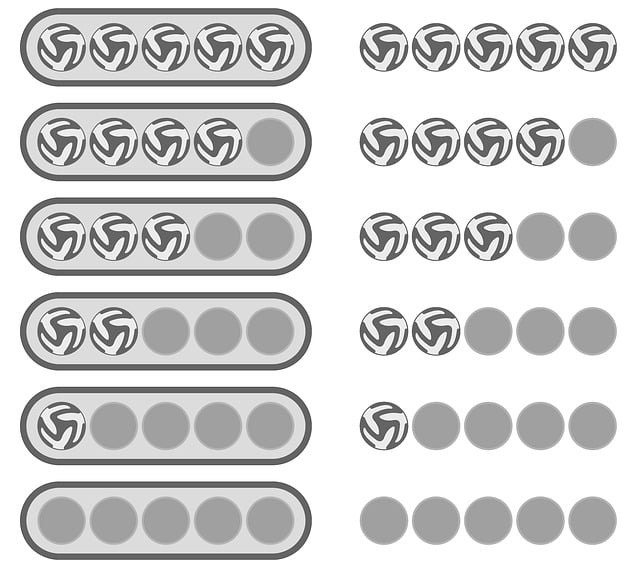

Effective use of vacancy rate market indicators involves comparing historical data over time and across regions. This analysis allows homeowners to predict market trends, anticipate changes in rental yields, and make informed decisions regarding purchasing or selling properties. By staying abreast of vacancy rates and their implications, homeowners can navigate the housing market with greater confidence, ensuring they secure favorable terms and prices that align with their financial goals.

Market Analysis: How Vacancy Influences Home Buyers' Decisions

The vacancy rate is a critical market indicator that significantly influences homeowners’ decisions when it comes to buying or selling properties. In many regions, high vacancy rates signal an oversupplied market, where sellers might need to be more flexible with pricing to attract buyers. Conversely, low vacancy rates indicate a strong buyer’s market, often characterized by competitive bidding and faster sales. Understanding these dynamics is essential for both real estate professionals and individual homeowners.

Market analysis plays a pivotal role in interpreting the impact of vacancy rate on home buying behavior. For instance, in cities with consistently low vacancy rates, like major urban centers during peak seasons, buyers face stiffer competition. This often leads to a surge in property values and requires prospective purchasers to be well-prepared with competitive offers. Conversely, areas experiencing high vacancy rates due to economic downturns or changing demographics may witness a softening of real estate prices, creating opportunities for cautious yet strategic buyers.

Effective use of vacancy rate market indicators involves keeping abreast of demographic shifts, employment trends, and local economic conditions. These factors can predict future demand and vacancy levels, enabling homeowners to time their transactions optimally. For example, regions with aging populations might see an increase in vacant properties as owners downsize or relocate, presenting buyers with a temporary surplus but also potentially unstable market conditions. By analyzing these indicators, real estate agents can guide clients on when to enter the market, while homeowners can make informed decisions about whether to list their properties for sale or rent.

Financial Implications: Assessing Vacancy's Impact on Property Values

The vacancy rate is a critical market indicator that significantly influences property values and homeowners’ decisions. When a home remains unoccupied for an extended period, it can have financial implications that ripple through the real estate market. One of the most direct effects is the potential decline in property value; vacant homes may lose their curb appeal, and the lack of regular maintenance can lead to deterioration, further reducing their worth. This is particularly evident in areas with high vacancy rates, where a surplus of empty properties can depress overall market values. For instance, a study by the National Association of Realtors found that homes sitting on the market for over 120 days had significantly lower selling prices compared to those sold within 30-60 days.

Financial institutions and lenders also closely monitor vacancy rates as they impact mortgage defaults and foreclosure risk. In regions with high vacancy, property values may drop below the loan amount, making it challenging for homeowners to refinance or sell their homes to cover debts. This scenario can create a vicious cycle, pushing more owners towards financial distress. To mitigate these risks, lenders often adjust loan terms or require additional collateral when lending in vacant or high-unoccupied areas.

Homeowners and investors can use vacancy rate market indicators to make informed decisions. By tracking these rates, they can anticipate potential value fluctuations and plan accordingly. For example, purchasing a home in an area with a rising vacancy rate might be a strategic move if the underlying economic factors suggest a future rebound. Conversely, selling during a low vacancy period could maximize profits. Effective use of vacancy data allows for a more nuanced understanding of the local market, enabling better financial planning and risk management.

Neighborhood Dynamics: Social Effects of High Vacancy Rates

The social dynamics of a neighborhood are intricately linked to its vacancy rate—a factor often overlooked when assessing property markets. In areas where vacancies dominate, communities can experience a ripple effect that impacts overall well-being and desirability. High vacancy rates can signal declining social cohesion, with businesses closing due to reduced foot traffic and neighbors moving away in search of more vibrant environments. This phenomenon creates a vicious cycle, further exacerbating the problem. For instance, a study in urban planning revealed that neighborhoods with persistent vacancy rates above 10% experienced a 25% decrease in community engagement events over a five-year period.

Market indicators such as vacancy rate and rental demand are vital tools for understanding these dynamics. Real estate professionals can employ strategies to mitigate the negative effects of high vacancy rates by analyzing these market indicators. For example, identifying areas with rising rental demand but low vacancy rates presents opportunities for developers to invest in new housing stock, thereby stabilizing or improving neighborhood dynamics. Moreover, implementing community engagement initiatives can foster a sense of belonging and reduce incentives for vacant properties, as seen in successful revitalizations where vacancy rates have dropped below 5% through collaborative efforts.

Homeowners and investors must consider the social implications of vacancy rates when making decisions. Investing in neighborhoods with high vacancy rates may require patience and a long-term vision to foster positive change. By understanding these dynamics, professionals can guide clients towards areas with thriving communities, ensuring their investments not only have financial returns but also contribute to the overall health and vitality of the neighborhood.

Strategies for Homeowners Facing Competitive Markets with High Vacancy

In competitive real estate markets characterized by high vacancy rates, homeowners face unique challenges when making decisions about their properties. Understanding how vacancy rate market indicators influence choices is crucial for navigating these dynamic environments effectively. When vacancy levels are elevated, landlords may need to adjust their strategies to attract and retain tenants, ensuring favorable terms and conditions despite the market conditions.

One practical approach for homeowners is to conduct thorough market research to identify trends in vacancy rates and rent prices. Analyzing historical data on local vacancy rates can provide insights into seasonal fluctuations and long-term patterns. For instance, regions with high student populations may experience temporary spikes in vacancy during summer months due to students returning home. By staying abreast of such market indicators, homeowners can time their listing strategies accordingly, potentially securing better rental terms. Moreover, understanding the relationship between vacancy rates and economic factors like employment growth or local industry shifts is essential for making informed decisions about property investments.

Additionally, offering competitive lease terms tailored to current market conditions can be a game-changer. This may include providing incentives such as reduced security deposits, longer lease terms with flexibility, or even temporary rent concessions during high vacancy periods. Such strategies foster good relationships with tenants and can help maintain a steady income stream in challenging markets. Homeowners should also consider the potential for property upgrades or renovations to enhance appeal and drive interest from a broader tenant pool, thereby reducing vacancy rates naturally.